Cash balance pension plan calculator

A 401 k is a qualified plan. A cash balance pension plan is a defined benefit plan that offers employees a stated amount at retirement.

Maximum Contribution Calculator Cash Balance Design

Cash balance offer largest annual tax deductible contributionssavings for business owners.

. Use this calculator to determine your maximum contribution toward your Cash Balance Plan for 2016. For more information or to do calculations involving each of them please visit the 401 k Calculator IRA Calculator or Roth IRA Calculator. Ad Do Your Investments Align with Your Goals.

This calculator will give you an idea of the potential. A Cash Balance Plan benefits calculator can be useful when determining the amount of money participants can receive upon retirement. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

The cash balance plan calculator amount is an estimate only for setting up the plan in the first year. Financial Advisers For Retirement Planning and How They Help You Plan for Retirement. Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

This calculator will help you figure out how much income tax youll pay on a lump sum this tax year. The Cash Balance Plan is assumed to be. The amount of money an employee receives can be determined.

Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Like a traditional pension a cash balance plan provides workers with the option of a lifetime annuity. For people with 1-5 years the average cash balances.

2022 Contribution Limits Table. Your maximum contribution to a Cash Balance. In the US today very rarely is the term DC.

Should you consider a lump sum pension withdrawal for your 500K portfolio. New Reason To Talk to A Financial Advisor. Please do not contribute to an already existing plan using our cash balance plan.

Choosing an option that guarantees a spouse pension benefits after your death means extra security but also lower monthly benefits. Married filing jointly or head of household. However choosing a pension plan option that only.

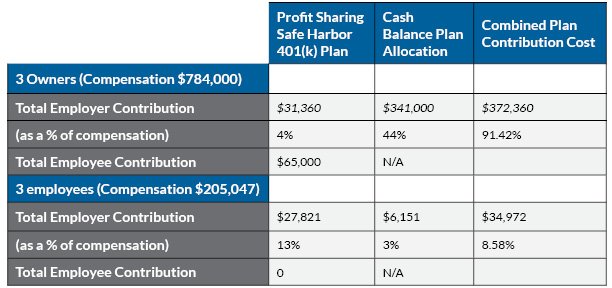

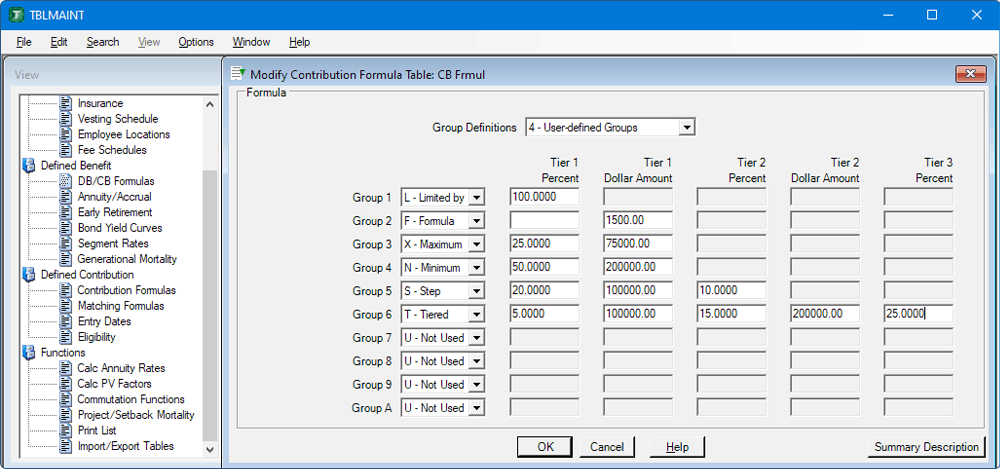

In a typical cash balance plan a participants account is credited each year with a pay credit such as 5 percent of compensation from his or her employer and an interest credit either a. The most common type of retirement savings in the United States is the 401k plan but defined benefit and cash balance plans are gaining popularity among self employed and small. The Cash Balance formula is of compensation and the Profit Sharing formula is of compensation where compensation is limited to the IRS maximum.

Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement. The most common uses for the Present Value of Annuity Calculator include calculating the cash value of a court settlement retirement funding needs or loan payments. A cash balance plan is a twist on the traditional pension plan.

Ad Ready To Turn Your Savings Into Income. A Retirement Calculator To Help You Plan For The Future. You can find Deloittes pension plan in there and they included a table of average Cash balances by age and years of service in the plan.

Cash balance plan formula example For every year that company employees participate in the plan they will accrue a benefit based on the formula below. These plans qualify for tax deferral. Ad Connect With Expert Financial Advisers and Seek Their Help To You Plan Retirement.

The Online calculator is designed for a company without employees other than the owners and generates a proposal for a Cash Balance and 401k Plan Proposal in less than 5 minutes. A Cash Balance plan is a type of retirement plan that belongs to the same general class of plans known as Qualified Plans. Ad We offer a range of retirement plan options that fit your needs business.

In addition the estimate for the Cash Balance. The maximum contribution for the profit sharing contribution may be limited due to certain deduction limits. Automated Investing With Tax-Smart Withdrawals.

For the purposes of this. This calculator has been updated for the and 2022-23 2021-22 and 2020-21. Find a Dedicated Financial Advisor Now.

Should you consider a lump sum pension withdrawal for your 500K portfolio.

One And One Makes Five Calculating The Minimum Required Contribution

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

Projected Benefit Obligation Pbo Definition

Beyond The 401 K Cash Balance Plans For High Earning Small Business Owners Chancellor Wealth

Cash Balance Plans For Businesses Fisher 401 K Solutions

Cash Balance Conversions

Cash Balance Plan Formula Easy 5 Step Process Video

Cash Balance Plans Accelerate Savings Maximize Tax Deductions July Services

Cash Balance Plans Erisa

Cash Balance Retirement Plans Annuity Options Cbs News

Maximum Contributions Additional Opportunities

Cash Balance Retirement Plan Guide

What Is A Cash Balance Plan Retirement Savings Beyond A 401 K

Cash Balance Pension Plans Explained Rules Formula Example Video

Cash Balance Plans The Retirement Strategy That Can Drive Big Tax Savings For Small Business Owners Rkl Llp

Cash Balance

Cash Balance Plans For Businesses Fisher 401 K Solutions