31+ Bad credit peer to peer lending

Instead of going to a bank for a traditional loan you borrow from individual people. Bad credit P2P loans are innovative products that help borrowers avoid alternative and payday loans.

What Happens When A P2p Borrower Stops Paying

Founded in 2010 Peerform provides loans to applicants with excellent credit scores who can enjoy interest rates as low as 599 but the maximum amount of loan that can be borrowed is.

. Peer to peer loans or P2P loans are an alternative to payday loans that can allow you to have access to money even if you have bad credit. First of all since youre dealing with borrowers this means that there is a chance for them not to pay. Turn to peer to peer lending with bad credit score with crypto source.

Click Now Apply Online. Prosper is a peer-to-peer lending marketplace that allows borrowers to apply online for fixed-rate fixed-term loans from 2000. See Cards Youre Pre-Approved for With No Harm to Your Credit.

After its creation in 2007 this is one of the oldest peer lending platforms. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. Founded in 2010 Peerform is an online peer to peer lending bad.

Applicants can ask for a loan amount between. Access Funds from 500 to 500000 for Any Purpose. Best P2P Loans for Bad Credit In many ways P2P loans are similar to loans with banks.

Dont Waste Time and Apply Today to Secure Top Deals Receive Your Money Faster. Compare Best Peer to Peer Lending Sites 2022. Ad Online Peer to Peer Lenders Low Interest Comparison Reviews Free Online Offer.

Ad Funds Arrive in your Account. How Peer-to-Peer Lending Works. Peer-to-peer P2P loans are made available through online platforms that pair potential borrowers with investors willing to issue loans.

Get Your Loan In 24 Hours. Bad credit borrowers may be approved for peer-to-peer loans even after banks have denied them. Its called peer-to-peer P2P lending and its growing at a rapid rate.

Best Peer-to-Peer Lenders for Bad Credit Lending Club Peerform Prosper SoFi Upstart. The Loan Club is an excellent place to lend bad credit loans if you have a minimum. They are otherwise known as money cupids or matchmakers offering rates as low as 3 for good credit customers and 99 Representative APR for those with poor credit.

Fast Easy Approval. Quick Online Multiple Choice Form. Peer-to-peer lending P2P is unique.

There are a few risks posed by the peer-to-peer lending sites for investors. Ad One Low Monthly Payment. 5 Best Peer-to-Peer Loans for Bad Credit Borrowers Credit.

10000 Vehicles Available - Get Your Down Payment Online - Shop and Apply Now. Compare Best Peer to Peer Lending Sites 2022. - between 690 and 719 is considered a good credit and 720.

Since several investors with high-risk tolerances can fund a single bad credit. Ad Use Our Risk-Free Pre-Approval Tool To Find Card Offers With No Impact to Your Score. All Credit Types OK.

Get Your Loan In 24 Hours. Best for peer-to-peer loans of up to 50000. Entertain only creditworthy borrowers and genuine lenders.

If you have bad credit and are struggling to find a loan peer-to-peer P2P lending may be an option for you. You have a much greater chance of being approved for a peer to peer loan than a traditional bank. But unlike the type of personal loan youre used to one from a family.

Apply With More Confidence. Loan Amounts and APRs. - between 630 and 689 is fair credit.

Cheaper loans with rates starting at 14. - Any score between 300 and 629 is considered bad credit by credit bureaus. Peer to peer loans are a great option for people who have bad or poor credit.

Safe and secured platform to ensure utmost privacy to both lenders and borrowers. Ad 10000 Vehicles Available - 1 In Bad Credit Auto Loans - Apply Online Now. Feb 07 2021.

Peer-to-peer lending is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary in the deal. Ad Connect with a Top Lender in Minutes. Ad Compare 2022s Best Bad Credit Loans to Enjoy the Best Rates in the Market.

Ad Online Peer to Peer Lenders Low Interest Comparison Reviews Free Online Offer. Since peer-to-peer lending is a form of online lending the entire process happens on the internet thus making every action digital action which of. The Best Offers from BBB A Accredited Companies.

A peer to peer loan is just what it. BBB AFCC Accredited. It is Easier and Faster.

No Obligation No Hidden Fees. This type of lending is much more user-friendly and. Peer-to-peer loans can be.

The global peer-to-peer lending market size is projected to reach 55891 billion by 2027 according to. Quick Process Loans up to 50000. OneMain Financial offers a pretty good range of loan options for people who need to borrow money.

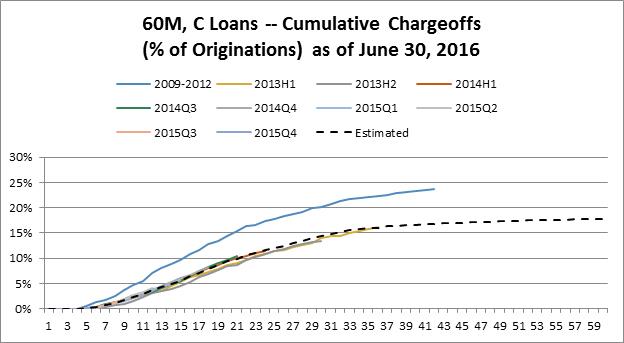

Prosper 424b3 20160630 Htm

Business Loan Alternative Crowdfunding Vs Peer To Peer Equity Crowdfunding Startup Funding Business Loans

Peer To Peer Lending An Alternative Source Of Finance Peer To Peer Lending Money Management Advice Economics Lessons

2

Peer To Peer Lending Personal Loans Best Payday Loans

Funny Quote Maybe P2p Lending Will Change This Peer To Peer Lending Business Loans P2p Lending

2

What Happens When A P2p Borrower Stops Paying

2

31 Important Contract For Difference Cfd Statistics Facts 2021

31 Important Contract For Difference Cfd Statistics Facts 2021

What Happens When A P2p Borrower Stops Paying

Faircent Is India S Most Trusted P2p Lending Platform Peer 2 Peer Lending Provides Alternative High Ret P2p Lending Peer To Peer Lending Personal Loans Online

What Happens When A P2p Borrower Stops Paying

What Happens When A P2p Borrower Stops Paying

2

2